or call for a FREE consultation.

and receive a copy of our FREE

Tax Relief Guide!

833-803-4222

Thank you for your interest in our tax relief services. At this time, we are unable to assist you. Please call 800-829-1040 to speak with the IRS and explore your options.

3 Tax Breaks For Families with Children

Parents can save a significant amount in taxes by using tax breaks geared towards families. The Child Tax Credit, Earned Income Tax Credit, Adoption Credit, Child and Dependent Care Credit, and Education Tax Credits are all essential tax credits worth exploring. At this time, however, we are going to take a deeper dive into the top three (3) tax breaks for families with children.

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a large tax break that can give low- to moderate-income families a financial boost. In 2019, the average tax credit was around $2,746, according to the IRS. To qualify for the EITC, you must:

- Provide proof of income

- Have investment income of $3,650 or less

- Be a U.S. citizen or legal resident

- Have a valid Social Security number

Taxpayers without children must also meet additional requirements, such as maintaining a home in the U.S. for at least six or more months a year and being between the ages of 25 and 64. If they are claimed as a dependent or qualifying child on another taxpayer’s return, they are ineligible for the EITC.

In certain situations, separated spouses may also be eligible to take this tax credit.

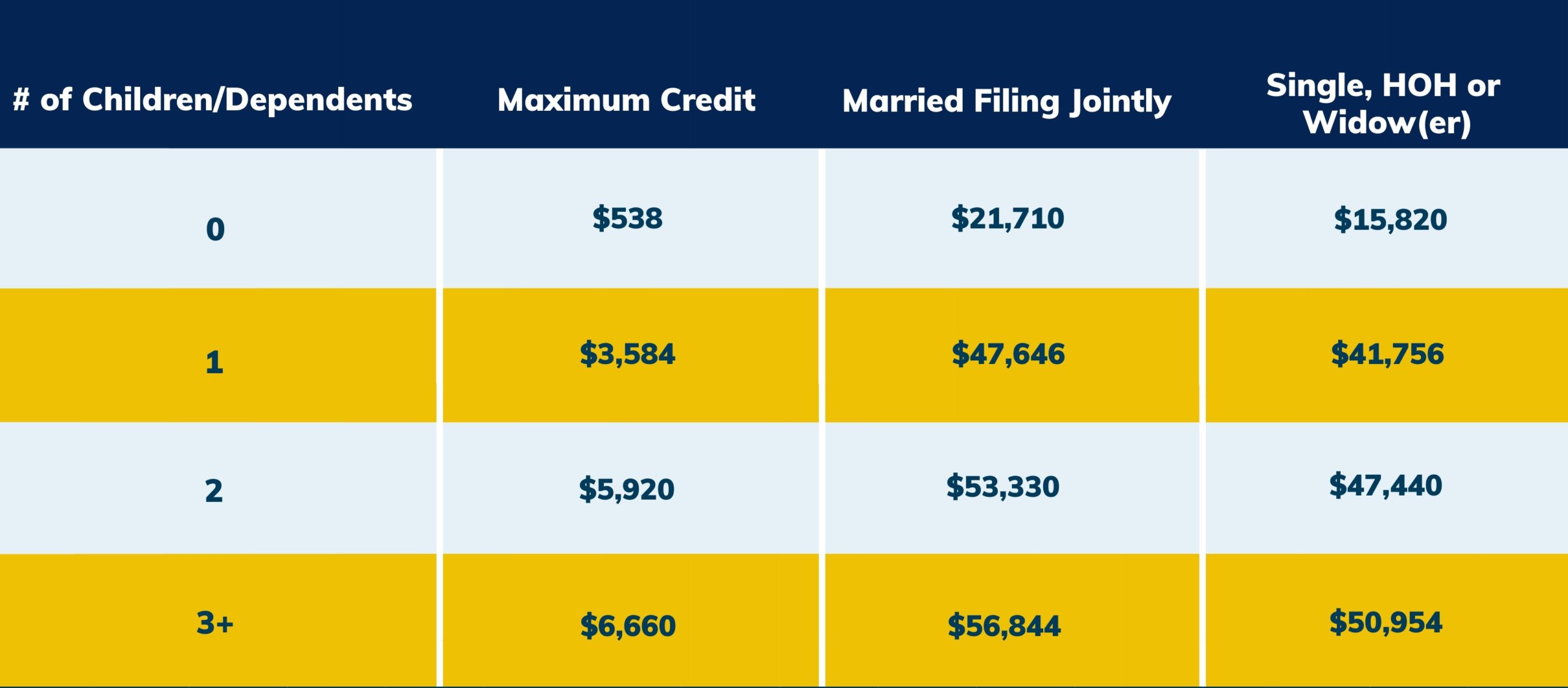

2020 Maximum Credit and Income Levels

The credit amount rises along with income up to a certain threshold, at which point it hits a maximum point. Once your income gets high enough, the credit starts to phase out until it disappears entirely at the maximum income levels shown above. The important thing to remember is that the credit is refundable, but you must file a tax return to receive it – even if you don’t owe any taxes.

Child Tax Credit

The Child Tax Credit is partially refundable. Taxpayers must have a qualifying child under the age of 17 or another eligible dependent to claim the credit.

Here are some numbers to know before claiming the child tax credit or the credit for other eligible dependents:

- $2,000: The maximum amount of the child tax credit per qualifying child.

- $1,400: The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax.

- $500: The maximum amount of the credit for other dependents for each qualifying dependent who isn’t eligible to be claimed for the child tax credit. This can include dependents over the age of 16 and dependents who don’t have the required SSN.

- $400,000: The amount of adjusted gross income for taxpayers who are married taxpayers filing a joint return before the credit is reduced.

- $200,000: The amount of adjusted gross income for all other taxpayers before the credit is reduced.

The Does My Child/Dependent Qualify for the Child Tax Credit or the Credit for Other Dependents tool can help taxpayers determine if their dependents are eligible.

Child and Dependent Care Tax Credit

Taxpayers may be able to claim the child and dependent care tax credit if they paid expenses for the care of a qualifying individual to enable them (and their spouse, if filing a joint return) to work or actively look for work.

The total expenses claimed may not exceed $3,000 (for one qualifying individual) or $6,000 (for two or more qualifying individuals). Generally, the following expenses are allowed:

- Childcare outside of the home

- In-home care, such as a babysitter or nanny

- Wages paid for qualified services, plus a portion of employment and payroll taxes

- Meals and/or lodging for an employee providing child and dependent care

- Day camp fees

- Before- and after-school care programs

Any expenses paid for childcare outside of regular working hours or while not actively searching for work should not be included.

Although childcare and dependent-care expenses paid to relatives who aren’t dependents are allowed, taxpayers may not claim any payments made to:

- Their children who are 18 or younger

- Any person they can claim as a dependent

- A spouse

- The parent of a qualifying individual, if the qualifying individual is the taxpayer’s child and is 12 or younger

Eligible taxpayers with adjusted gross income (AGI) of $15,000 or less can claim 35% of their eligible expenses for a maximum potential credit of $2,100. The percentage of expenses a family can claim decreases as income increases until families with AGI of $43,000 or higher reach the minimum 20%, which qualifies for a maximum potential credit of $1,200.

Unlike the Earned Income Tax Credit and the Child Tax Credit, the Child and Dependent Care Tax Credit is non-refundable.

For information on any of these tax credits, speak with a tax professional or visit IRS.gov.