or call for a FREE consultation.

and receive a copy of our FREE

Tax Relief Guide!

833-803-4222

Thank you for your interest in our tax relief services. At this time, we are unable to assist you. Please call 800-829-1040 to speak with the IRS and explore your options.

What is FBAR and Do I Have to File One?

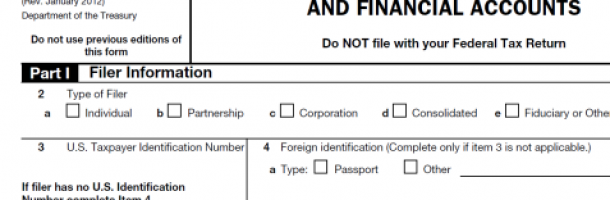

You might be required to file the Report of Foreign Bank and Financial Accounts (FBAR) if you have funds in a foreign financial institution. Any U.S. person (explained below) having a bank account, brokerage account, mutual fund, trust, or any other kind of foreign financial account is required to file an FBAR, if the funds exceed a certain threshold. The FBAR can be filed electronically with the Department of Treasury every year.

Do You Need to File an FBAR?

If you are a United States citizen, you are required to file an FBAR if you fulfill these two criteria:

1. You had a financial interest in or a signature authority over at least one financial account overseas.

2. The total value of all your foreign financial accounts exceeds $10,000 at any time during a calendar year.

This applies if you are a U.S. citizen, U.S. resident, or a U.S. entity (corporation, partnership, trusts, etc.).

Are You Exempt?

Not every U.S. citizen or resident holding funds overseas is required to file an FBAR. You are excluded from filing if you:

- Jointly own with your spouse certain foreign financial accounts

- Are owners and beneficiaries of U.S. IRAs

- Participate in and are beneficiaries of tax-qualified retirement plans

- Are an international financial institution or a government entity owning foreign financial accounts

- Are included in a consolidated FBAR

Certain individuals with signature authority over but having no financial interest in a foreign financial account are exempt from filing. Trust beneficiaries are not required to file; this applies when a U.S. person reports the account on an FBAR filed on behalf of the trust. Correspondent/Nostro accounts and foreign financial accounts maintained on a U.S. military banking facility are also exempt from filing.

Filing an FBAR

The FBAR can only be filed electronically using the FinCEN’s BSA E-Filing System. The deadline for filing an FBAR is April 15. If you file to file on time, you’ll receive an automtatic extension to October 15. The FBAR is not filed with a tax return.

Penalty for Not Filing

Willfully failing to file or retain records, or filing a false FBAR, can lead to criminal penalties that include fines up to $500,000 or time in prison (5 to 10 years).

If you did not file FBARs previously, but reported and paid taxes for your foreign financial accounts on your U.S. tax return, the IRS will not impose a penalty for failing to file an FBAR. It is important to file all delinquent FBARs, however, to avoid an audit.