or call for a FREE consultation.

and receive a copy of our FREE

Tax Relief Guide!

833-803-4222

Thank you for your interest in our tax relief services. At this time, we are unable to assist you. Please call 800-829-1040 to speak with the IRS and explore your options.

Archive for the ‘Tax Prep’ Category

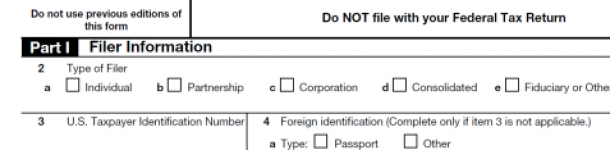

What is FBAR and Do I Have to File One?

You might be required to file the Report of Foreign Bank and Financial Accounts (FBAR) if you have funds in a foreign financial institution. Any U.S. person (explained below) having a bank account, brokerage account, mutual fund, trust, or any other kind of foreign financial account is required to file an FBAR, if the funds exceed a certain threshold. The FBAR can be filed electronically with the Department of Treasury every year. Do You Need to ...

read more »Manage Your Quarterly Tax Payments Using These Methods

For many, tax season is not the only time to make tax payments. Those making estimated tax payments, such as freelancers and the self-employed, may be required to pay taxes each quarter of the year. The first quarter for 2016 fell on April 18, and the following quarters fall on June 15, September 15, and January 17, 2017. Not making tax payments on time can lead to penalties and interest. To manage your quarterly tax ...

read more »Do I Need an EIN?

Most businesses are required to have an Employer Identification Number (EIN). It is a nine-digit number that is used by the IRS to identify a business. The EIN is used by the business when filing its tax returns. When You Need an EIN Businesses need an EIN if any of these conditions are met: Your business has employees If you operate your business as a corporation or a partnership If you file any of these returns: employment, ...

read more »When to Report Income Held in Foreign Banks

If you are a U.S. citizen or a resident alien, you are required to report and pay taxes on all income within and outside of the U.S. Additionally, you must also report on your tax return any foreign bank accounts or foreign investment accounts, even if those accounts do not generate any taxable income. Foreign Bank and Financial Accounts (FBAR) If you have a foreign financial account, including a bank account, brokerage account, mutual fund, unit ...

read more »7 Most Popular Tax Deductions Average Americans Claim

The following tax deductions are some of the most popular deductions because a large number of taxpayers are eligible to take advantage of them. The Motley Fool looked at past IRS data to find the provisions that most benefitted the roughly 147 million taxpayers who filed tax returns, in the most recently available tax year. Here is what they found: 1. Personal exemptions The most commonly used provision to reduce taxable income ...

read more »Missing a Filing Extension

If you believe that you won’t be able to file your tax return on time, you should request an extension before the filing deadline. To file for an extension, use Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. After you file the form, you automatically receive 6 additional months to file. Businesses may use Form 7004 or Form 1138 to file for ...

read more »Common Deduction And Credit Errors

Making errors in deductions and credits can ultimately result in having to pay back taxes. Additionally, after the filing deadline, any taxes owed will be compounded by penalties and interest. In order to avoid an IRS issue, taxpayers should avoid deduction and credit errors, such as: Claiming Charitable Contributions A large number of taxpayers deduct charitable contributions on their returns. Only contributions to charities that are eligible to be deducted should be considered. To avoid making a ...

read more »The Dangers of Failing to File

Failing to file a tax return can lead to serious consequences. Taxpayers that do not file their tax returns before the filing deadline face penalties and interest on the taxes owed. The penalty is charged every month on the total back taxes. Due to the accumulation of penalties and interest, the amount of unpaid taxes increases substantially with time. Penalty For Non-Filing Failure to file a return and failure to pay taxes are different kinds ...

read more »How and Why to Amend Your Return

You may file an amended return if you think you made a filing error or forgot to claim credits, deductions, or dependents. If you forgot to attach tax forms with your return, however, you may not amend your return. The IRS will ask you to send those. Generally, you can amend a return up to three years after filing it. How to Amend a Tax Return To amend Forms 1040, 1040A, or 1040EZ, you need to file ...

read more »Should You Make Quarterly Tax Payments?

Estimated tax payments are not only for the self-employed. They are used to pay taxes on any income that is not subject to withholding. If you prefer ‘pay as you go’ over a once-a-year lump sum payment, you can pay taxes four times a year. Employees who have their taxes withheld from their paycheck may use estimated taxes if they have other income sources. Estimated tax is used to pay income tax, self-employment tax, and other ...

read more »